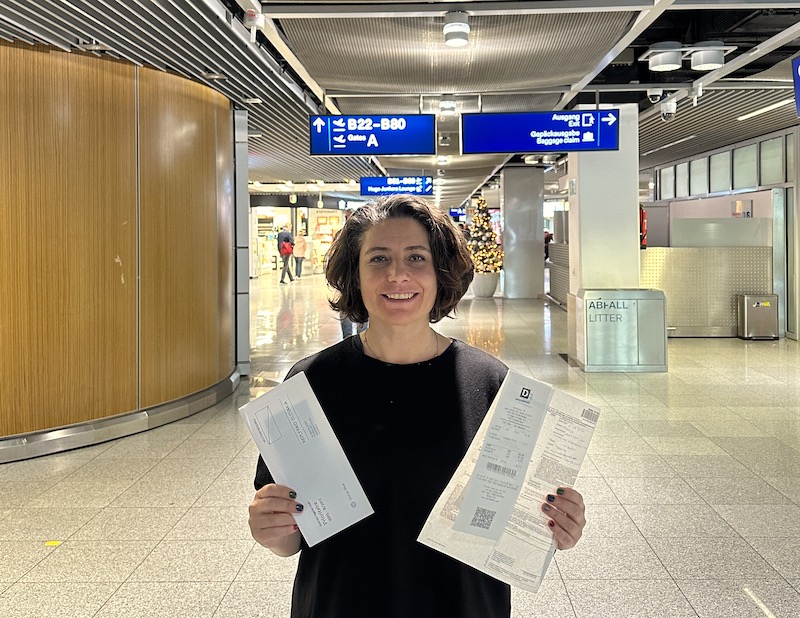

Tax free; The name given to the application that allows you to get a tax refund if you are going to shop abroad, since you are not a taxpayer in that country. tax refund. After making your shopping, you can get your tax refund at the airport and/or customs points when returning to the country. Let's look at the details of this application together!

What You Will Find In This Article

What is Tax Free?

Tax Free is the name given to the application that allows you to get a tax refund on certain amounts of purchases you make in countries where you are not a taxpayer. Tax refund rate and lower limit, rules and processes vary from country to country, and some countries may not even have a Tax Free application at all. Therefore, if you are planning to shop in the country you will travel to, I recommend that you research the Tax Free application of that country before you go.

How to Get a Tax Refund for Foreign Purchases?

If there is a Tax Free application in the country you shop in;

- Tax Free has lower limits that vary depending on the country: such as 25€ or 50€. The shopping amount you make must be above the minimum tax refund payment limit of that country.

- The store you shop at must apply a tax refund. You will see the TAX FREE label on the door of the stores where you can get a tax refund.

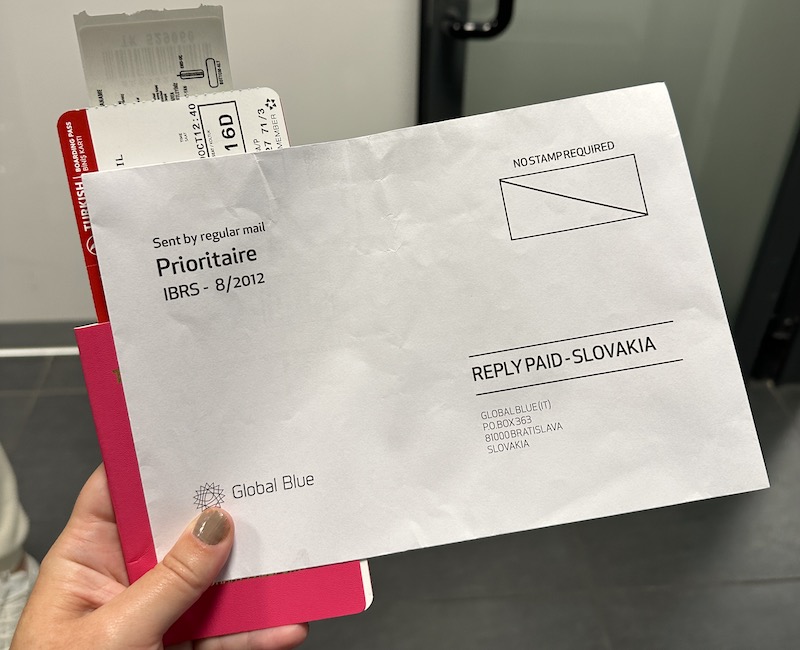

- If you have shopped above these limits, you need to inform the store you shopped from that you want to get a tax refund. The store will give you a signed/stamped tax free form along with the invoice of the product. This form replaces your tax return. The form may sometimes be in a letterhead envelope or sometimes only in A4 format, do not worry about the shape, they all serve the same purpose.

- On returning to Turkey; When you arrive at the airport or border gate, you must first get this form approved at customs. You need to go to customs with your passport, shopping documents, and your credit card if you paid by card. The customs officer may ask you to show the products, and this practice may vary from country to country and even from city to city.

- You can receive your tax refund in cash or to your credit card by going to Tax Free contracted payment points with the form approved by customs. Different companies such as Global Blue and Tax Refund process our tax refunds. You can find information about the most up-to-date applications and payment points on the websites of these companies.

- If there are no payment points or they are closed when you arrive at the airport and/or border gate, you can also request your tax refund by mail. Some airports may have a mailbox for you to leave your documents, so as I mentioned at the beginning, practices may differ from country to country or even city.

- If you did not receive your tax refund in cash at the airport, the refund period to your credit card may vary from country to country and may take up to 30/60 days.

There are usually directions at airports for customs and payment points. If there is no direction, you can ask the information desk or inquire online without going to the airport.

– If you are going to put the products you have purchased into your luggage, before the security check,

– If you are going to carry it in hand luggage, you need to carry out your transactions after control.

In Which Countries Is Tax Free Valid?

There is no Tax Free application in England, United Arab Emirates and some states of America.

Countries where Tax Free is valid; Germany, Argentina, Austria, Bahamas, Belgium, Czech, China, Denmark, Estonia, Morocco, Finland, France, Croatia, Netherlands, Ireland, Iceland, Italy, Spain, Sweden, Switzerland, England, Japan, Korea, Cyprus, Latvia, Lebanon, Lithuania, Luxembourg, Mexico, Hungary, Norway, Poland, Portugal, Russia, Singapore, Slovenia, Slovakia, Turkey, Uruguay, Greece.

The above list may also be subject to change, so if you research the Tax Free application of the country you will visit before you travel, you will not be disappointed later.

For which products is the tax refund valid?

Tax refund rates, lower limits and which products they apply to may vary from country to country. If we look at the general framework; Tax refunds can be received for products in the following categories that are outside the service sector.

- General Consumer Goods: General consumer goods such as clothing, shoes, jewelry, perfumes and cosmetics.

- Souvenirs: Products such as souvenirs, local handicrafts, ceramics and ornaments purchased for touristic purposes.

- Luxury Products: Products from luxury brands, especially high-value watches, jewellery, leather bags, branded clothing and accessories.

- Electronic Items: Smartphones, laptops, tablets, digital cameras and other electronic items.

It is possible to say that the products for which the most tax refunds are received are in the clothing and electronics category.

What is the Tax Free Rate?

Tax Free rates vary from product to product and country to country. You can get the clearest information about the return rate you will receive from the store clerks where you shop. Since there are differences between 5% and 20%, I cannot give an exact rate in this article.

What You Need to Know Before Claiming Tax Free

As I often state, although practices differ in each country, some general information is valid for all countries.

- You must get a Tax Free form from the store you shop at; it is not possible to get a tax refund without that form.

- In some cities, there are Tax Free offices within the city. You can ask the store staff while shopping or get detailed information on the website of the company whose name is on the tax free form.

- In order to benefit from a tax refund, you must be a tourist in the country where you shop. If you have stayed in that country for more than 3 months, have a residence permit, or are in that country for education purposes, you cannot get a tax refund.

- You cannot get a tax refund on service expenses, but you can benefit from a tax refund on products.